InRush Ticker Plant

Ultra-low latency market data for buy-side and sell-side use cases.

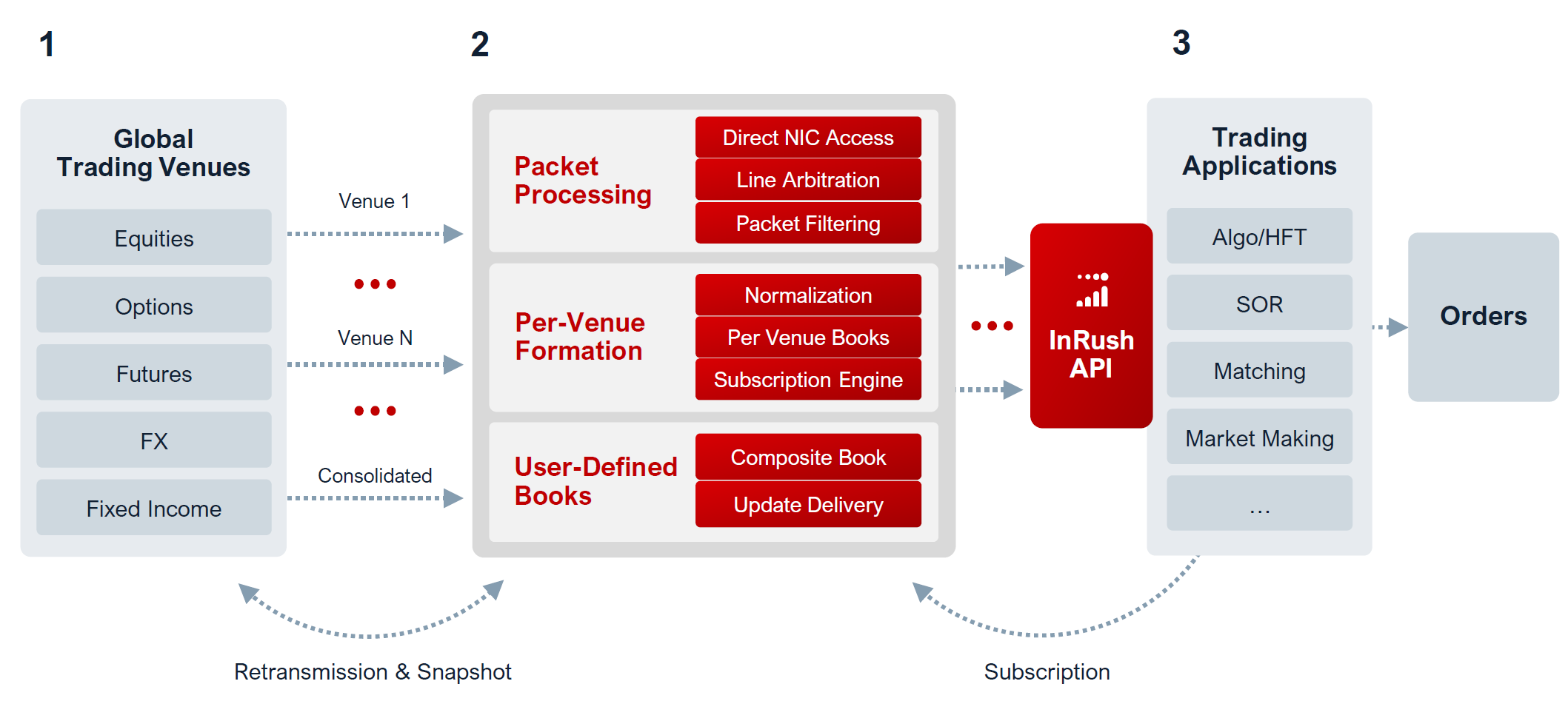

Redline’s InRush™ Ticker Plant is a highly optimized enterprise-class feed handler that terminates market data from multiple feed sources on a fraction of a single server. InRush maintains full-depth books for all symbols on the wire with an emphasis on low latency and determinism.

Running on industry-standard Intel®-based multicore servers, our feed handler delivers ultra-low latency intelligent trading events to your trading applications for equities, options, futures, FX and fixed income markets.

By directly connecting to over 180 global trading venues, InRush helps you discover the most accurate pricing and capture the best trading opportunities in the market.

6 out of the top 7 global banks and dozens of hedge funds combined rely on InRush Ticker Plant because it is the most accurate and lowest latency market data available.

Access Liquidity Faster

API to wire measured in microseconds to nanoseconds depending on use-case

Control Trading Risks

Perform risk checks and track order status while managing portfolio state

Execute Trades More Reliably

Persistence engine enables intraday order state recovery

The InRush API offers sophisticated subscription options that power ultra-low latency creation of order-level and price-aggregated books from direct feeds.

Information overload is avoided by delivering only the market data of interest to each trading application.

Deploy with ease

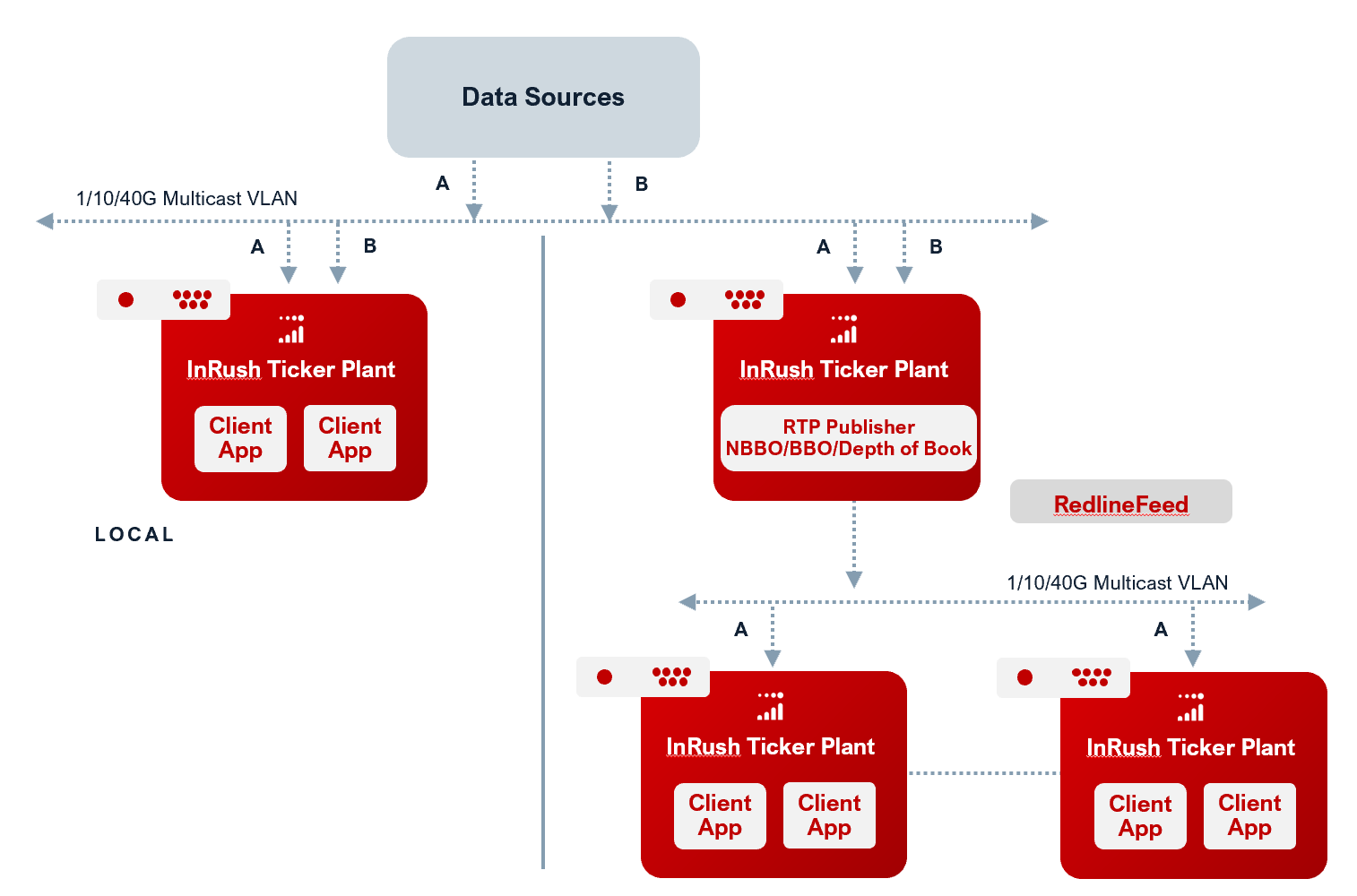

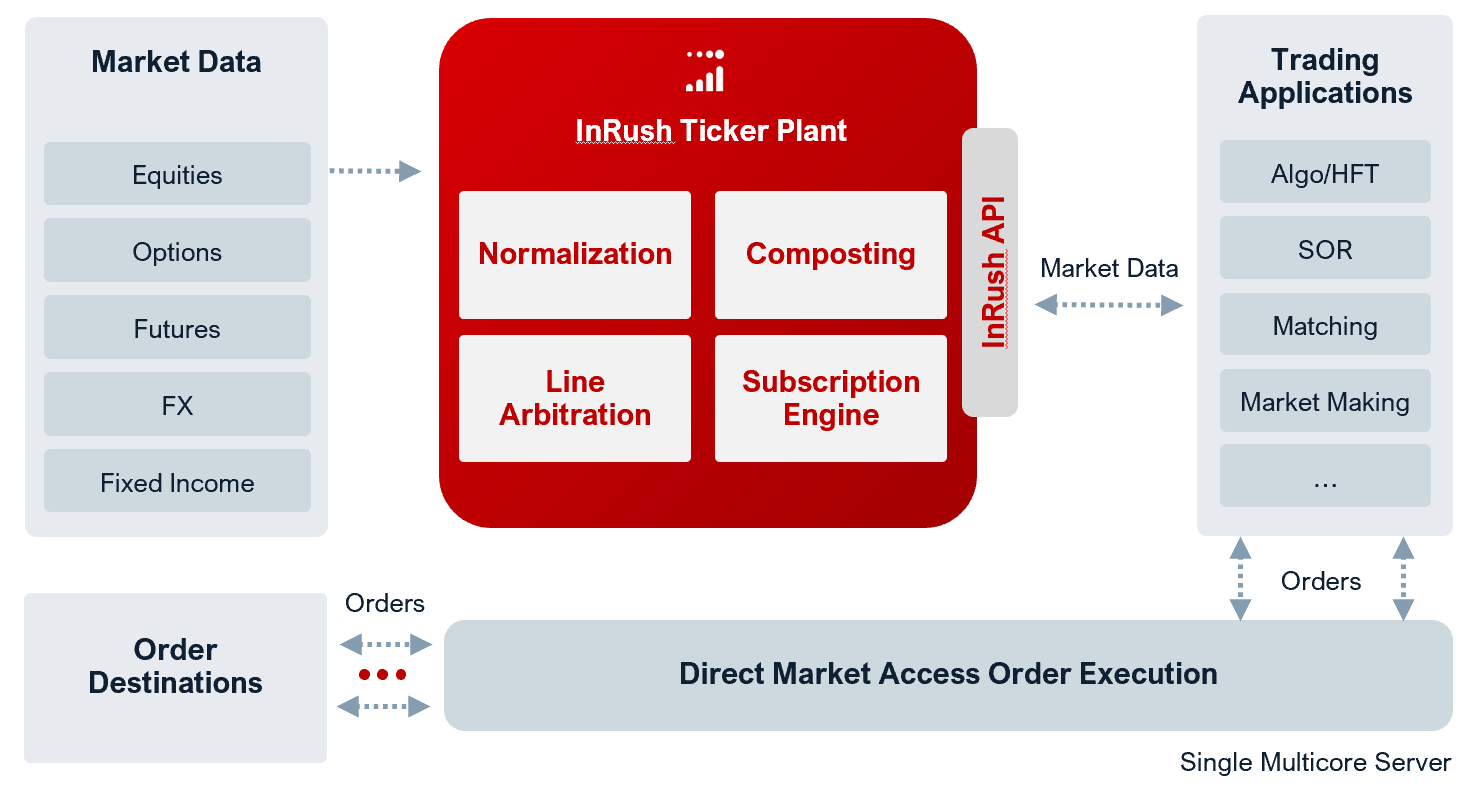

InRush Ticker Plant may be deployed in a single Linux® server embedded with your trading application and our optional Order Execution Gateway for ultra-low latency.

It may also be distributed via RedlineFeed™, our consolidated feed, fanning out to subscribers across your enterprise. With Redline Managed Service, we can offload deployment, operational, and capital expenditures from your organization. Redline Managed Service provides proximity co-location, exchange and market access connectivity, pro-active monitoring, and low latency infrastructure to enable faster trading a lower cost.

Couple with optional execution gateway for a single server trading solution

InRush Features

Flexible ways to view the markets

Over 180 Global Trading Venues Supported — in equities, options, futures, foreign exchange, and fixed income

Receive Intelligent Market Data — delivered via polling queues, ultra-low latency snapshot, or callback

View Order and Price-Aggregated Books — managed at top-of-book or user-specified depth-of-book levels

Composite Books Across Venues — generating a synthetic BBO (e.g., NBBO for U.S. markets or EBBO for European markets) with more timely and accurate prices

Know Complete Status for Every Security — quote and sale conditions; trading and limit up/limit down status

Replay History — Pcap recording and replay of recorded data across markets with nanosecond precision timestamps

Enterprise Deployment Options — Deploy across your enterprise with conflation and delayed services

Choose Time and Quote Conflation for Slow Consumers — minimizing delay from handling outdated data

Subscribe to User-Defined Weighted Baskets of Securities — creating hundreds of baskets on a single server

Set Subscription Filters to Receive Only the Data Needed — by trades only, quotes only, or price changes only

Access Market Maker Capabilities — for handling mass quotes, RFQs, and auctions

Built-in Ultra-low Latency Performance

Architected for Ultra-Low Latency and Determinism — core design scales efficiently for all types of subscriptions

Tightly Coupled with Our Order Execution Gateway — for tick-to-trade performance of under 3 μsec

Highly Optimized for Intel’s Microarchitecture and Low-Latency Network Adapters

Enterprise-Class Data Integrity

Reliable Market Data — with line arbitration, gap detection, packet retransmission, and book snapshots for late join

Automatic Subscription Migration — seamless failover from direct to consolidated feed; revert after snapshot

Capability to Suppress Problematic Venues — and to restore them, intraday, upon resolution of the issue

Crossed and Locked Book Detection and Clean Up — with customizable user alerts

Book Clearing for No-Delay Recovery — allows book to “rebuild” with new messages

Historical Packet Capture Replay — delivers market data for trade compliance verification and event forensic score design scales efficiently for all types of subscriptions

Responsive Support for the Complete Trading Cycle

Rapid Support for Exchange-Driven Changes — our updates are sped by our avoidance of proprietary hardware

Feed Handlers Tested with Live Market Connectivity — and continuously monitored for responsive support

Web-Based Real-Time Redline Monitor — alerting you to problems with any feed with line arbitration, gap detection, packet retransmission, and book snapshots for late join

Deploy Your Way

Embedded and/or Distributed Deployment — as a single co-lo server; as RedlineFeed for global enterprise distribution

Transport via Reliable Multicast/Unicast, or Third-Party Messaging Middleware — to Linux® and Windows® clients

InRush Managed Service Options — to free up IT resources and reduce operational costs