Intelligence Hub

Real-time forensic visibility into all transaction flow with zero performance impact.

Corvil Intelligence Hub provides visibility into transaction execution quality to correlate client trading behavior with execution path and counterparty performance.

Precision visibility into trade execution performance to help maximize alpha.

Fast Time to Value

Directly connect to Corvil streams with ease and take advantage of AI-assisted setup for a quicker configuration process. The normalization process is already set up, and you can use the pre-built dashboards right away without any extra work.

Precision Visibility

Maintain a complete record of execution, utilizing passive instrumentation that record nanosecond-precise timestamps; ensuring that the data is reliable.

Trade Analytics

Provide real-time transaction analytics, live order state tracking, and a multi-dimensional topological model for visualizing complex data.

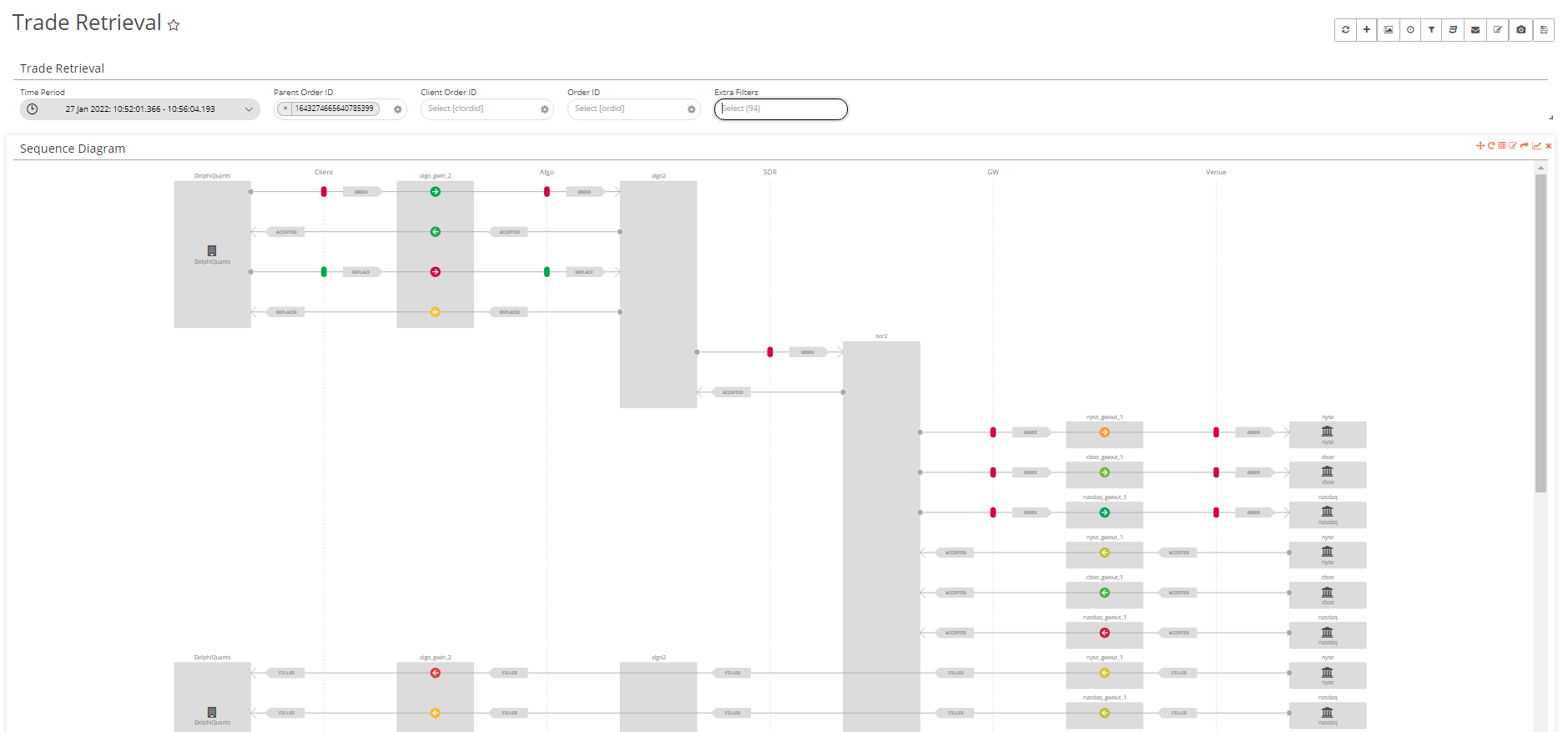

Trace individual transactions across every hop and parent/child slice. Monitor aggregate transaction performance to reveal which execution paths and applications are impacting a specific client or strategy.

Full trade traceability, from client-to-market across every hop and parent/child order slice

Isolate degraded decision, application and network latencies with an individual transaction

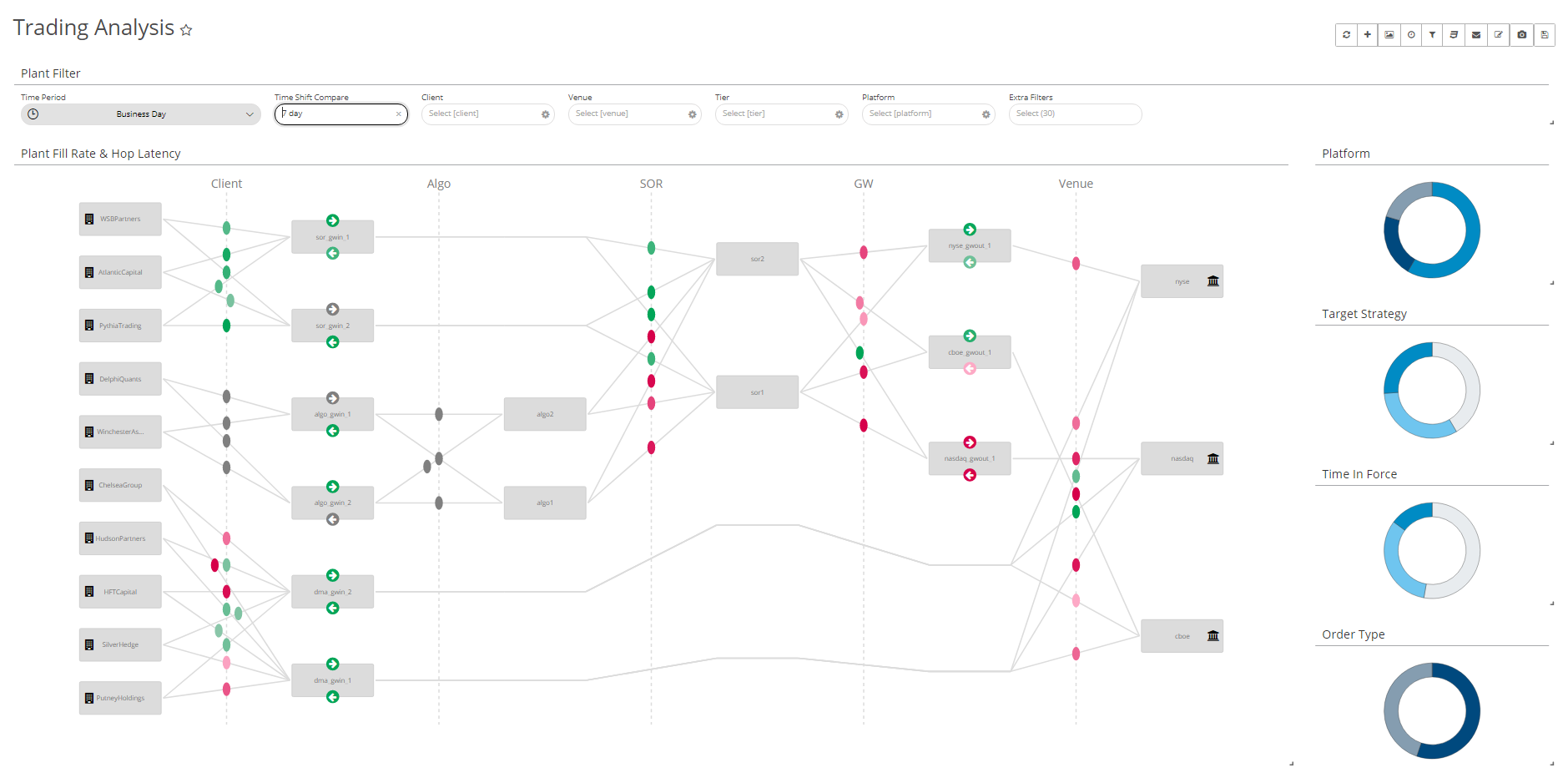

Monitor aggregate transaction performance and isolate for specific clients and/or strategies, to review their execution path and reveal the application, component, and markets that impact trading success

Correlates key performance metrics with trading metrics for granular insights into how IT infrastructure, connectivity and counter parties impact trading outcomes.

Calculate any latency: such as client-to-market, parent to 1st child, sub-leg, path, hop and response times

Calculate various trade metrics: fill rate, hit rate, reject ratio, cancel ratio, trade notional and more

Business Challenges

Sell-Side

The buy-side is using transaction cost analysis tools and algo wheels to evaluate broker trade performance. This leads to more flow reallocation and client churn for the sell-side. Corvil Intelligence Hub provides real-time insights to the sell-side. They can measure trade plant performance using the same metrics as the buy-side. This allows the sell-side to detect service impacting problems and changes in client behavior proactively.

Market Makers

Regulators require exchanges to monitor the volume of unexecuted orders to prevent disorderly trading conditions (e.g., MiFID II RTS-9). Exceeding exchange order-to-trade ratios (OTR) limits can incur fines or suspensions. Corvil Intelligence Hub allows market makers to walk an optimal line between high-frequency order replacement to deliver best bid-offer spreads while being compliant with regulatory requirements that limit the volume of unexecuted orders placed on the exchange by members.

Buy-Side

Traditionally, buy-side firms have had to rely on separate tools to provide insight on infrastructure performance, service performance, business intelligence, and trade execution analytics. Corvil Intelligence Hub streamlines this process by using advanced machine learning to establish key execution quality performance metrics and to provide real-time alerts on anomalies in trading behavior and execution quality. This enables proactive operations and business management without waiting for the trading desk to complain or lose their edge, and provides buy-side firms with better insights into their trading outcomes.

Intelligence Hub Features

Transaction Analytics

Trace individual transaction across every hop and parent/child slice. Monitor aggregate transaction performance to reveal which executions paths and applications are impacting a specific client or strategy.

Order State Tracking

Order state independently tracked for each application and market, to monitor order status and alert on overfills, underfills, open children, exposure, unacknowledged requests, latency and more.

Trade Analytics

Correlates key performance metrics with trading metrics for granular insights into how IT infrastructure, connectivity and counterparties impact trading outcomes.

Transaction Monitoring

Reconciliation and transaction completeness monitoring to detect application outages, failed transmission, with the associated impact on client, strategies and orders.

ML & Analytic Alerts

Machine learning and analytic alerts, to detect problems as they happen to mitigate business impact; through a range of neural network, analytic baselines, predictive analytics and thresholds.

BI & Reports

A rich variety of business intelligence and specialized trading visualizations. Brochure-quality reporting, to provide brand-aligned execution transparency to clients and internal stakeholders.