RedlineFeed

Normalized market data consolidated into one high-performance hosted feed.

RedlineFeed™ delivers normalized low-latency multi-asset class market data, built from direct feeds, in a cost-effective manner. The service offers market participants the performance benefit of direct feeds without the challenges of exchange connectivity and feed protocol changes.

Features

Reliable Architecture

Cost-Effective Market Data

Turnkey Service

Multi-Asset Class Support

Market Data as a Service

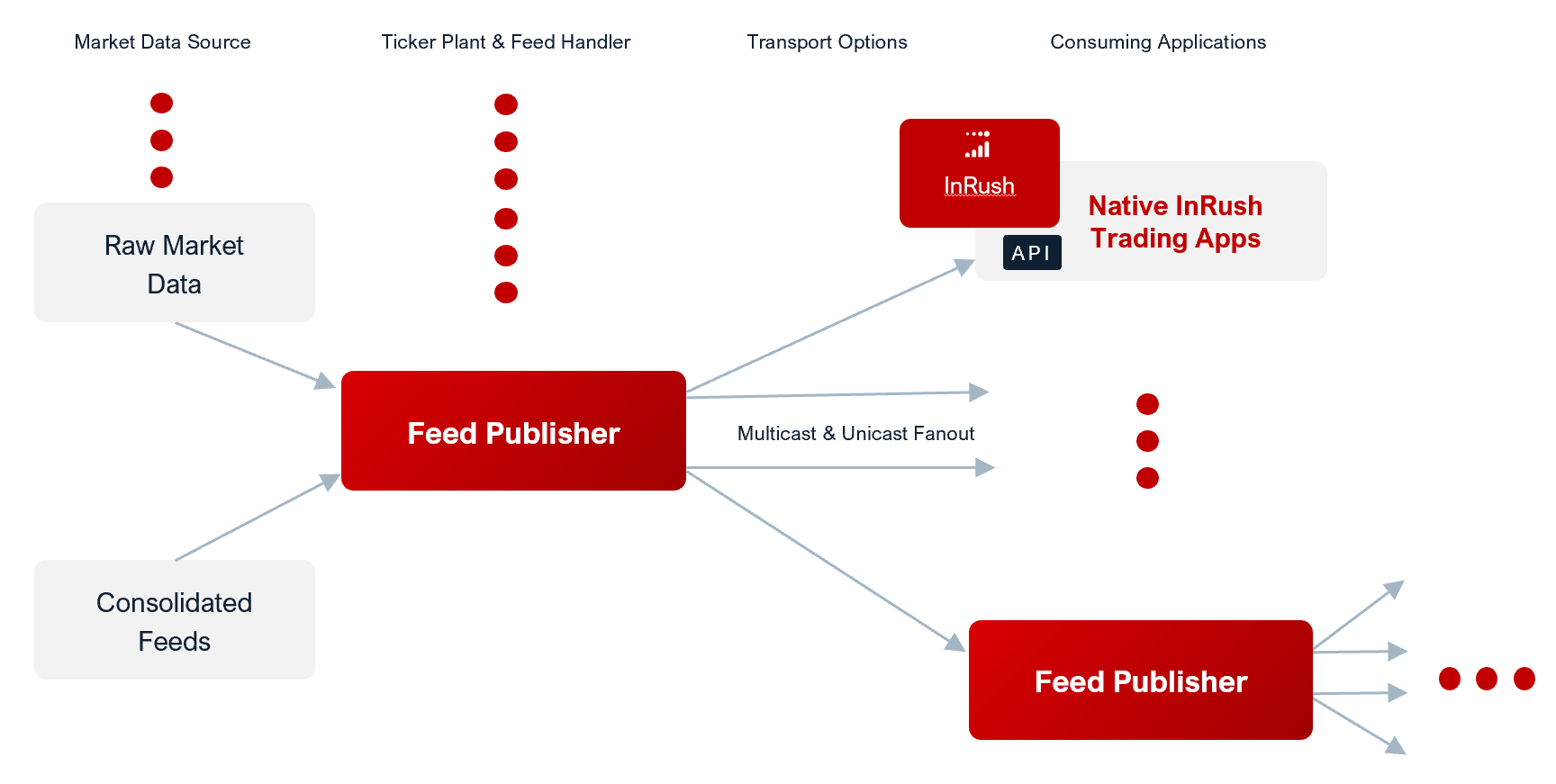

RedlineFeed is distributed from a publishing hub hosted and managed by Redline experts and is delivered on each subscribing application server by a locally embedded InRush™ Ticker Plant instantiation. Client applications receive normalized market data updates via the easy-to-use InRush API and via legacy API bridges. A redundant architecture assures a high availability feed, and book snapshots allow for client midday restart and recovery of book state after line gaps.

RedlineFeed publishers can be customized to publish a variety of use-case specific information such as a synthetic Best Bid & Offer for equities and options, user-defined BBOs per market, a user-configurable depth feed, or conflated quotes.

The subscribing server can also formulate a subset of the data it receives and reliably republish it to downstream client subscribers. By cascading market data to edge caches that support hundreds of endpoints, a variety of quality of service levels can be met for global trading and monitoring use cases across the enterprise.

Redline Solution Benefits

Access Multiple Markets via a Single Fast Connection — through a fully managed and hosted solution

Receive High-Quality, Low-Latency Market Data Sourced from Direct Feeds — at user-configurable depth

Customized Views of Market Data — composite books, synthetic Best Bid & Offer, conflated quotes

User-Defined Striping — assign content for a symbol set or symbol range to specific multicast channels for fan-out

Multi-asset Class Market Data — from global equities, options, futures, foreign exchange, and fixed income trading venues

Write to One API to Access All Published Venues — and use our Bloomberg and Reuters bridges for legacy applications

Performance Where It Matters

Straight-Line Aggregation — we co-locate with the matching engines you choose to co-lo with, minimizing transmission latencies

Nearly as Fast as Redline’s Direct Feed Solution — single-digit microseconds from exchange tick to your trading application

Optionally Conflated at the Source — minimizing the processing burden on slow consumers of handling outdated data

Renowned Ultra-low Latency Architecture — optimized on mainstream multicore servers without the burden of FPGAs

Lower Total Cost of Ownership

Minimize Your Exchange Fees — via Pico market data

Pay Only for What You Need — pricing based on number of trading venues/servers and the tier of Managed Services requested

Significantly Reduce Operational Costs — by collapsing server footprint and outsourcing exchange connectivity

Managed and Hosted as You Prefer

Redline Managed — we set up and manage the infrastructure with our hosting partner and monitor our feed service for you

Managed by Your Service Provider — we work with your preferred hosting partner to enable them to support the RedlineFeed

Self-Managed — we assist your IT team with infrastructure configuration and train them on our monitoring tools

Scalable, Reliable Market Data

Scalable on Both the Publisher and Receiver Side — enabling enterprise-wide deployment

Linux and Windows Client Application Server Support — for ubiquitous deployment, including monitoring

Redundancy Enabled with Two Multicast Feeds — secondary server available for automatic failover

Any Multicast Gaps From the Exchanges Are Detected and Trigger a Snapshot — for reliable market data

Unified Support

Single Support Contact for All Market Data — free up IT resources and reduce operational costs