Exchange Driven Change Initiatives (EDIs) are defined as technical changes introduced by major trading venues that impact clients who connect to their systems. Pico’s broad range of products all include some kind of interaction with trading venues infrastructure and systems, including Pico Raw and Historical Market Data, Corvil Analytics, Redline Software and Network Connectivity. All of these offerings have extensive venue coverage globally, ensuring Pico is uniquely positioned to manage and support these EDIs.

EDI changes can include massive projects like data center migrations and network infrastructure upgrades, down to more minor upgrades affecting messaging protocol updates or data content changes. Large or small, EDI changes involve the constant looming possibility of systems crashing on a Monday morning and, therefore, require a highly rigorous process to validate impact and a careful change management process in preparation for any changes.

In addition to the seriousness of these EDI changes’ impact, the mandated change rate across global venues continues to be at a high and growing rate in 2024.

EDI Management is a Priority

Pico is committed to ensuring EDIs are managed effectively and has a global and integrated EDI management process intended to promote consistency across product lines and, most importantly, ensure transparency for Pico clients. Clients need to be clear in real time about the impact on products, delivery status, and the next steps required for each project.

This blog will look back at key EDIs supported in the first half of 2024 and look ahead to what’s coming up in the remainder of the year.

Q1 2024

5,340 incoming venue notifications received and assessed

101 changes raised for detailed technical impact assessment

56 new EDIs identified from new notices

25 completed EDIs launched in production inside of Q1

2024 got off to a busy start in EMEA for several venues, including Cboe Europe, TRADEcho, BME and Nasdaq OMX with the 1st January Go-Live of the new MMT (Market Model Typology) v4 standard, resulting from recent updates to Trade flagging requirements that were initially raised under MiFIR/MiFID II (RTS 1 and RTS2) regulations in 2018. Upgrades were required for Redline Software and Corvil decoders to handle modifications to market data and order entry protocols for impacted venues.

High-impact changes for key AMRS venues quickly followed at the beginning of February with the CME Glink Network Infrastructure upgrade on 4 February 2024 and the eventual go-live of the OPRA 96 channel expansion initiative after several delays on 5 February 2024. The OPRA channel expansion, in particular, required significant advanced effort in 2023 to upgrade PicoNet to 100Gbps infrastructure to handle the increased OPRA bandwidth requirements, a change which ultimately impacted virtually all Pico Product lines and a very significant number of clients.

Q1 2024 rounded out with several other key go-lives across EMEA and AMRS venues. In EMEA, BME London Hub migrated to new network infrastructure on 3 March 2024, requiring the installation of new physical lines and network configuration changes for impacted clients. On 25 March 2024, Borsa Italiana completed Phase 3 of its migration to the Euronext Optiq platform, with the Italian Derivatives market migrating this time. In AMRS, Montreal Exchange rolled out new market data and order entry protocol versions on 1 March 2024, requiring both network connectivity updates as well as changes to Redline software applications and Corvil Decoders to handle new messaging specifications introducing support new Guaranteed Cross Auction Functionality on the Exchange.

Q2 2024

5,748 incoming venue notifications assessed

159 changes raised for detailed technical impact assessment

85 new EDIs identified from new notices

18 completed EDIs launched in production inside of Q2

Throughout April, NYSE went live with market data specification updates across its Equities and Options markets. This introduced a new Security Status / Halt condition value to many of its proprietary feeds, requiring updates to Redline’s InRush feeds to normalize the new value correctly.

On 29 April 2024, several UK venues regulated by the Financial Conduct Authority (FCA), particularly Cboe BXE, LSE, Turquoise, and TRADEcho, adopted the new MMT Typology model version 4. In addition, LSE at the same time introduced two new GTP market data channels and re-balanced instruments across existing channels to alleviate message rates on more heavily loaded channels. As a result, these changes required mandatory network configuration changes to be deployed alongside software updates for both Redline InRush feeds and Corvil Decoders impacting many clients.

Successful go-lives continued throughout May 2024 in EMEA. Firstly, the rollout of Eurex and Xetra T7 Release 12.1 impacted both Market Data and Order Entry protocols, requiring updates to Redline software and Corvil Decoders. Secondly, for SIX Swiss, the previously postponed June 2023 Co-Location network infrastructure upgrades requiring mandatory hard-cut networking changes to be deployed by Pico were completed successfully on 25 May 2024.

Finishing Q2 2024, there were further go-lives in June across all regions. In EMEA, SIX Swiss went live with SIX Maintenance Release (SMR) 13 on 10 June 2024, deploying updates related to MMT v4 and Quote on Demand Service enhancements requiring mandatory updates to Redline InRush software. In AMRS, Cboe sunset their Options 1 Gbps PITCH Depth of Book feeds due to increasing bandwidth requirements and the planned launch of new Cboe Options 8 Gbps feeds at the end of July. This significant change was announced at short notice, requiring Pico to procure an additional 10 Gbps dedicated Options lines from Cboe and quickly onboard and deploy the 5 Gbps PITCH feeds to affected clients. In APAC, the Shanghai Stock Exchange completed its transition to new Level 2 Tick by Tick combined data messages at the end of June, phasing out existing individual order and transaction messages requiring mandatory software updates to process the new message types.

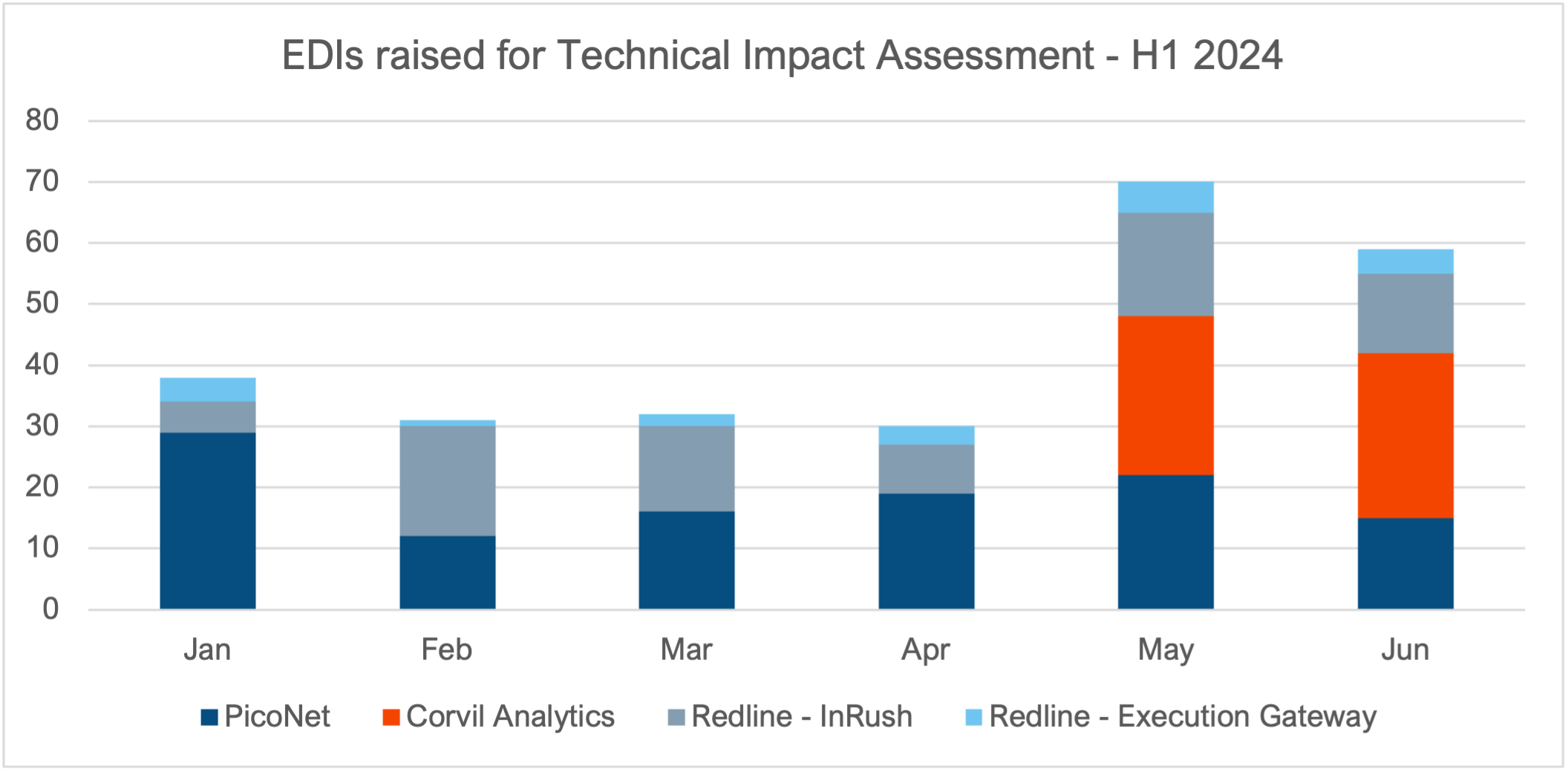

260 EDIs were raised for detailed technical assessment in the first half of 2024.**

** Corvil statistics began counting towards figures from May

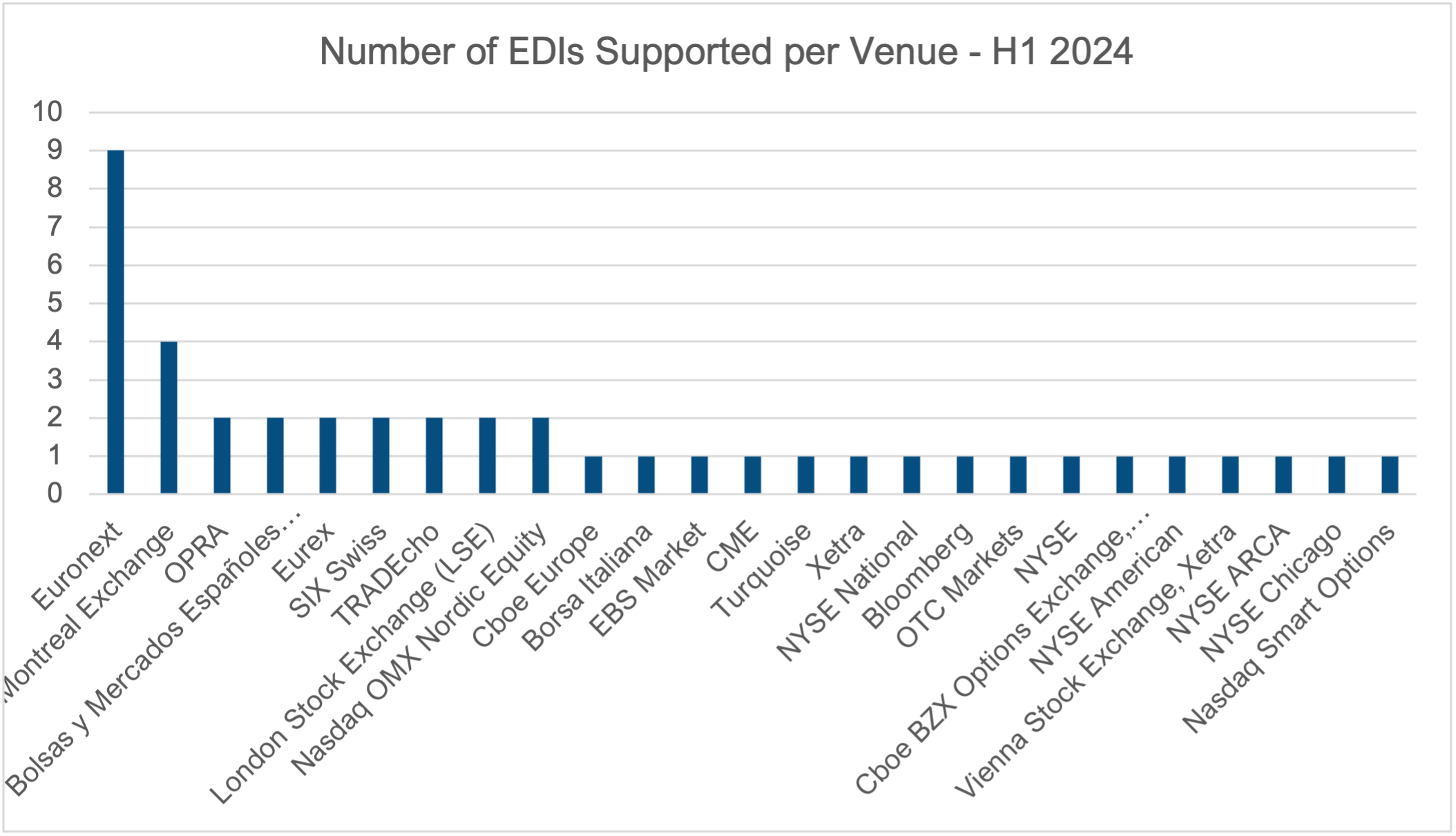

43 total EDI changes delivered for Production go-live across 25 venues in the first half of 2024.

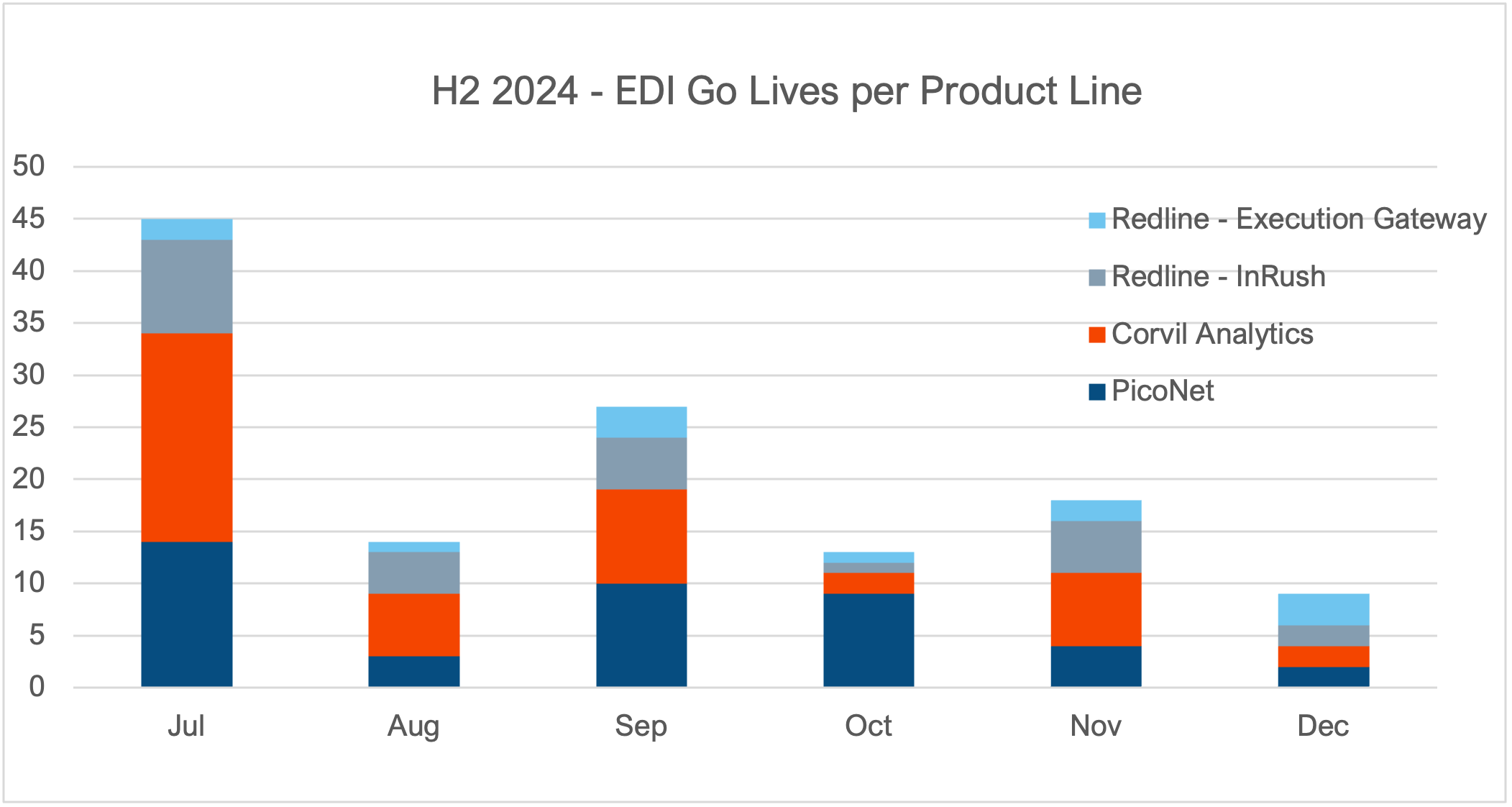

EDI Pipeline for Q3 / Q4 2024

The second half of 2024 is set to be equally busy, if not busier, with a number of high-impact platform replacement initiatives going live across several venues.

In Q3 2024, the new MIAX Sapphire Options Exchange will launch on 12 August 2024 and introduce a new OPRA participant. On 16 August 2024, NYSE BQT will fully migrate onto the NYSE Pillar publishers from legacy XDP publishers. This change required network configuration and software updates all of which have already been deployed and released for impacted clients. Blue Ocean Technologies also recently announced that their planned platform migration to MEMX Technology will be complete as a hot-cut event on 16 August 2024 as well, requiring clients to deploy a new feed compatible with the new protocol. Blue Ocean market data will also now be available on PicoNet as a result of a new connectivity partnership between Blue Ocean Technologies and Pico.

On 9 September 2024, further platform migration initiatives will go-live for Nasdaq ISE Options and Finra venues, with both upgrades impacting multiple product lines requiring network configuration as well as Redline Software and Corvil Decoder changes be deployed for impacted clients.

There will be no letup of re-platform initiatives, with major migrations continuing into Q4 2024 in both EMEA and APAC. In October, LME will switch to its long-anticipated new Trading platform, and LSEG FX will undertake a switch migration initiative in LD4. This initiative will require clients to establish new cross-connects to new network infrastructure to support that migration.

On 5 November, JPX Group will launch Arrowhead 4.0 and a new Market by Order market data feed, replacing their existing FLEX Full protocol, which is intended to improve user experience with greater market data detail being available. Required network configuration changes, Redline software, and Corvil Decoder updates are all in progress to handle these changes.

Finally, LTSE is also in the middle of platform migration, adopting MEMX Technology. The go-live date is still to be confirmed, but it is expected to be sometime in the second half of the year.

Pico clients will receive further communications over the coming months regarding delivery status, next steps, and the action required for each of these initiatives.