It’s been quite the week on global markets. As traders and portfolio managers scrambled to adjust their positions in response to the largest shake-up in the global trading landscape in a generation, volumes surged worldwide. The sudden rise in activity provided a real-world stress test close to the 2x headroom requirements regulators typically mandate.

So, how did the markets infrastructure hold up?

Pico, with a global footprint, is in a unique position to see macro and micro activity across markets. Using Corvil Analytics, the Pico Operations team has identified microbursts and bottlenecks in the global system during these historic peaks that show how the markets infrastructure is holding up in real time during this real-world stress test.

Here’s a snapshot of what we’ve seen so far.

A Week of Elevated Activity Across the Globe

Following the initial announcement of potential tariff increases on Wednesday, April 2nd, a surge in global trading activity was quickly observed—and it hasn't slowed since.

Global Summary:

Tick rate increases (April 2-8 compared to the previous week):

- AMRS: +50% -- 17.5 Trillion ticks compared to 11.7 Trillion

- EMEA: +56% -- 704 Billion ticks compared to 451 Billion

- APAC: +30% -- 19.2 Billion ticks compared to 14.7 Billion

Global Market Data under pressure: Pico monitors market data latency, comparing tick publish time to the packet timestamp at Exchange cross-connect. We are seeing evidence of delays in market data publishing well above normal levels, showing exchange feed assemblers are struggling to keep up.

Massive processing load: PicoNet AMRS CNEs handled over 1.3 petabytes of market data during the past week, with a peak of 313TB daily volume in AMRS.

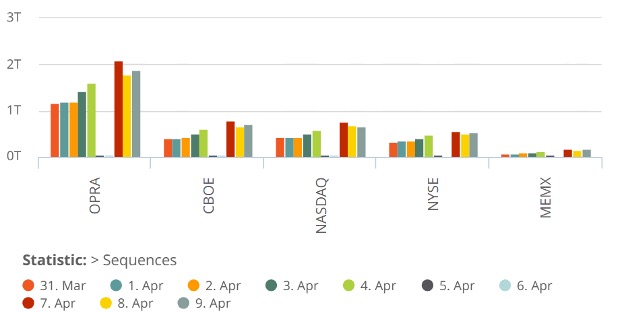

Consistent surge: Daily increases in sequence counts have continued since the announcement, indicating sustained heightened trading volume and volatility.

Despite these elevated volumes, the Pico network infrastructure has remained resilient, with no material degradation in performance or increase in packet loss.

🇺🇸 AMRS: Data volumes surging across all markets, with Options especially hit

AMRS markets saw a +50% jump in total market data volumes from April 2-8 compared to the previous week, largely driven by:

Increased activity, particularly in OPRA and Cboe feeds, as the options markets reacted to massive swings in the outlook for the global economy. On April 8th, OPRA volumes were 77% higher than the previous Monday.

A clear spike in market data and WAN traffic around 13:00 ET on April 7th—timed almost precisely with the tariff news announcement.

Daily tick volumes by AMRS market, from 31 March through 9 April – OPRA daily volume doubled on April 7 compared to previous week

Volumes continue to show:

No significant market data gaps – even as data volumes rise.

Consistent Pico latency performance – Pico’s WAN latency percentiles have been rock-solid, validating infrastructure readiness during market stress events.

Evidence of bottlenecks in feed publishers:

Despite doubling the number of lines last year, the OPRA feed shows evidence of upstream bottlenecks, slowing down the feed

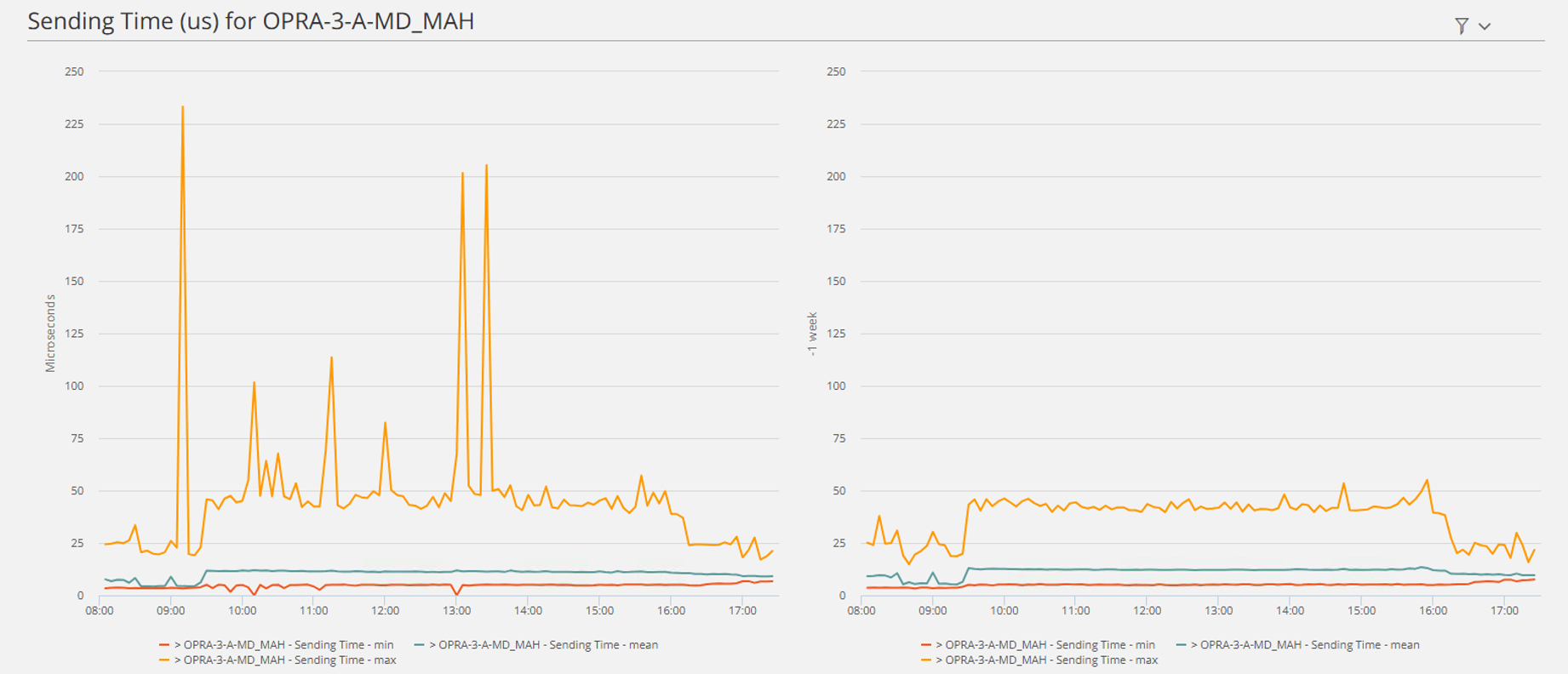

On April 7, OPRA showed multiple spikes in latency, at the 100G cross-connect into PicoNet in the Mahwah data center. Corvil measures, per tick, the time between the tick timestamp and the packet arrival time. Compared to previous week, we can see multiple spikes to 200+ microseconds. Similar week-on-week increases in latency spikes were observed in multiple feeds.

OPRA Tick latency, for April 7th (left) compared to March 31st (right), showing evidence of congestion in OPRA feed assembly of up to 225us

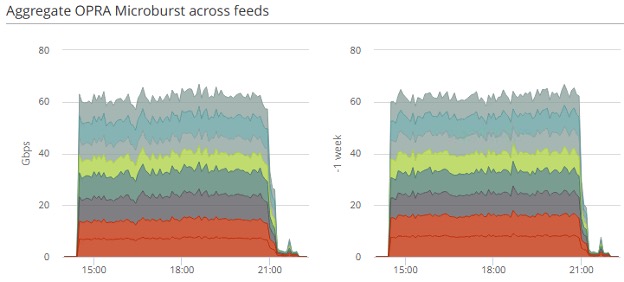

At the same time, the 1ms microburst across OPRA A+B feed was virtually unchanged between April 7 and the previous week. This is because the 96 OPRA publishers were already sending market peaks at their maximum rate, and were unable to increase their sending rate, causing the feed latency. Microburst is an extremely important metric, but doesn’t give you the whole picture. Corvil is able to decode OPRA in realtime, and calculate the tick-to-receive time to give insight into staleness compared to direct feeds.

OPRA Aggregate Microburst showing peak rates largely unchanged week on week, at approximately 65Gbps, due to capacity bottlenecks in the feed assembly

🇪🇺 EMEA: Strong Gains, Carrier Outages

EMEA markets experienced a remarkable +99% increase in sequence counts on Monday, April 8th. However, that activity was accompanied by network disruptions due to carrier outages:

Several WAN circuits were down due to a carrier outage in Paris, including:

- IT3<>TH2 Secondary

- BME<>IXL PrimaryLondon Metro link (LD4<>IXL PRI) showed noticeable increases in bandwidth usage—a clear indicator of intensified market stress.

Earlier in the week, EMEA trading showed:

A 49% increase in sequence counts on April 3rd.

Stable WAN performance and minimal packet loss despite elevated traffic.

Market Data aggregate bandwidth across all feeds in London LD4 Datacenter on April 7 (left) compared to March 31 (right)

Key Takeaways

Trading activity has surged across all global regions since the announcement of new tariff measures, with record-high sequence counts and network bandwidth consumption.

Pico’s Infrastructure has held strong, thanks to the robust design of the Pico global network and Corvil’s real-time analytics.

Market Infrastructure has been under pressure, with bottlenecks detected in several feeds, underlining the importance of regular 2x Industry-wide stress testing exercises.

The alignment of market bursts with geopolitical news (e.g., China tariffs) further illustrates how real-time visibility is essential for operational awareness in volatile environments.

Why It Matters

In high-volatility events — like this week’s tariff-driven market reaction — there are many opportunities for profitable trading, but also major risks to market participants whose systems and service providers under-perform. Pico and others using Corvil analytics have actionable telemetry not just to detect market peaks but also to ensure gap-free data feeds and visibility of market data staleness. Strong infrastructure underpinnings enable financial firms to:

Maintain trading continuity

Detect and resolve network anomalies instantly

Adapt algorithms and risk appetite in realtime, even under stress

The Pico team will continue to monitor the situation closely and share key updates as this story unfolds.